PNGi INVESTIGATES

PNG Architect Defeats Malaysian Timber Dynasty

Architect, Lucky Manoka, from Barakau village in Central Province served the public for ten years at the National Housing Commission, and National Capital District Commission. After earning a Master’s in Architectural Studies at the University of Queensland Manoka went into private practice.

Manoka later established a company in 2005, Bootless View Estate Limited, along with two colleagues Willia Lapa and Ila Hore

They then put in bid for a plot of agricultural land, Portion 878, at Bootless Bay. Under their proposal Bootless View Estate would spearhead an agricultural development in phase one, and in the second phase, a residential block.

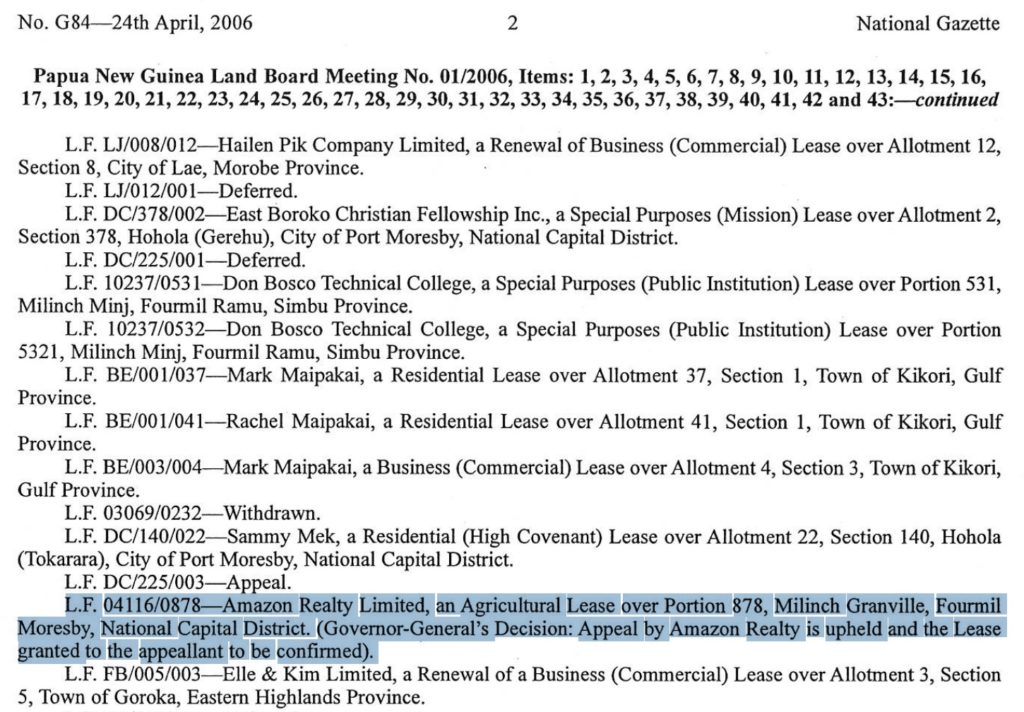

They won the initial Land Board tender in 2005, but there was an appeal. Bootless View Estate won the second Land Board tender in 2006. But, again, there was an appeal.

Image: Bootless Bay captured using Google Earth

The Lands Minister, Puka Temu, then overruled the Land Board on the basis of advice given to him by the Lands Secretary, Pepi Kimas. The land was instead awarded to Amazon Realty Ltd on 27 March 2006. At the time Amazon Realty Ltd was an ailing, indebted firm. On paper its shares were owned by three PNG nationals and a Nepalese citizen.

Yet it proposed a K1 billion development, complete with casino, five star hotel, shopping complex, complimented by timber processing industry, and a deep sea wharf. This was arguably the most ambitious mega-development in the history of PNG, all of which would be engineered by a small company in economic hardship.

Things then changed for the company. In 2012 Amazon Realty Ltd passed into the hands of a wealthy Malaysian family. The Hii timber merchant family are millionaires, with a worrying international record.

Lucky Manoka and his colleagues at Bootless View Estate, however, were not prepared to forfeit their rights to this Malaysian consortium.

Today we tell story of the land at Bootless Bay that pitted a small local businessman against one of the mightiest families in Malaysia.

Amazon Realty's Billion Kina Dream

Amazon Realty Limited is the company at the centre of this land conflict.

Amazon Realty’s submission to the 2006 Land Board hearing proposed a mega-development at Bootless Bay, of a kind never seen before in PNG. It would have a timber processing centre, and a deep sea wharf. From there, it was proposed, the company would move on to construct a five star hotel and international casino.

The Minister for Lands, and Lands Secretary, were so convinced by the business plan that they were prepared to overrule the Land Board, who had awarded the land to Bootless View Estate Limited.

So who were the shareholders standing behind Amazon Realty Limited? James Packer, perhaps, the billionaire Australian proprietor of Crown Casino?

You would think, but no.

The company, on paper, was evidently in financial dire straights, and owned by three nationals, and a citizen of Nepal.

Its shareholders and directors, who have all since passed away, were:

- Kakau Biribudo (PNG)

- Evan Gill Iewago (PNG)

- Paul Nari (PNG)

- Kajeem Ghotane Gurung (Nepal)

Former athlete Evan Iwago, and Paul Nari, appear to have been fairly small-time businessmen, with a modest commercial footprint. Kakau Biribudo had a wider range of interests in logging, palm oil, and resource extraction, where he was tied to a range of foreign investors, particularly from the Philippines.

Kajeem Ghotane Gurung is a little more complex figure. His business partners included the disgraced former Forestry Minister Ted Diro (via Aviation Equity Ventures), and a swag of Malaysian business people.

There is nothing to suggest any four of these men had the sort of assets or experience, to fund a billion kina mega-development.

Company minutes dated 6 May 2007 in fact suggest Amazon Realty was in a dire financial state, as a result of lavish spending by the late Evan Iewago.

The company’s financial returns from this period report assets of K15 million and liabilities of K250,000. Despite the significant surplus, this would appear to primary be non-liquid assets, in the form of the state lease over land at Bootless Bay.

We then see on 21 September 2012, some five years later, Amazon Realty’s Annual General Meeting minutes refer to a foreign investor, Monarch Development Pte Ltd.

The meeting minutes are signed by Paul Nari, Kakau Biribudo and Malysian national Eii Sing Hii.

Minutes from a Board of Directors meeting dated 14 March 2013, describes Monarch as the project’s ‘existing developer/financier’.

While there was a complex set of share transfers taking place between 2012-2013, ultimately it was the Singapore based Monarch Development Pte Ltd which acquired 80% of the company (as set out in the 2012 minutes), with the Public Curator, Jacob Popuna, owning the remaining 20% on trust for the late Biribudo, Nari and Gurung.

Monarch Development Pte Ltd has a complex ownership structure. However, PNGi has traced the shareholders in its Singapore and Australian holding structure. This inquiry revealed Eii Sing Hii is ultimately the single largest shareholder.

The Hii Timber Merchant Dynasty

According to a 1994 article in the Australian Financial Review (AFR), ‘Mr Hii is managing director of a large timber and construction business in South-East Asia … his private group had been investing in Australian property for about 15 years’.

The AFR notes Eii Sing Hii is part of the wealthy Hii timber merchant family. The Courier Mail reports it is ‘a family who made its fortune felling century-old forests in the Malaysian state of Sarawak, on the island of Borneo’.

Eii Sing Hii’s brother is Yii Ann Hii.

Both have acquired substantial property interests in Australia. In 1996 the AFR confirmed ‘Eii Sing Hii, owns the Paramount development in the Melbourne CBD. The five-building office and casino property is next to the World Congress Centre on the Yarra River’.

The same article reports that Yii Ann Hii part owned Melbourne’s World Trade Centre, and a building in Brisbane’s CBD.

The Hii brothers also have a wide range of interests in PNG. Yii Ann Hii is reported to hold 138,000ha in timber concessions, and a five bedroom compound in PNG. Eii Sing Hii also has significant PNG timber and land interests.

The Hii brothers have generated significant controversy.

Yii Ann Hii is being chased by the Australian Tax Office for a $60 million debt. Hii evidently claims he is penniless. The Courier Mail on the other hand suggests, ‘Sir Yii Ann Hii owns palatial houses worth $45 million and a fleet of luxury cars but he is crying poor to delay paying a $60 million tax bill’.

Eii Sing Hii has also courted controversy.

The NGO ‘Grain’ reports that ‘Hii Eii Sing is … the owner of Sebekai Plantation Sdn Bhd, which has a 5,000 ha oil palm concession in Bintulu, Sarawak, where communities have established blockades and held protests to try and get their lands back from the company. In 2003, he was arrested by the police in Indonesia for his role in illegal logging in the Merdey sub-district of Manokwari on behalf of PT Rimba Kayu Arthamas, a Jakarta-based company with a concession in Papua’.

Eii Sing Hii has provoked similar controversy in PNG.

His company PMS Timber Limited was found to have acquired over 42,100 hectares in Buna, Central Province, through an invalid sub-lease. The SABL Commission of Inquiry recommended the lease be revoked.

Another Hii company in hot water is Northern Forest Products Limited, which was the subject of a previous PNGi report.

That piece covered a Ministerial Brief authored by PNG Forest Authority’s Tunou Sabuin. The Ministerial Brief states that although a Forest Clearance Authority (FCA) was issued to Northern Forest Products Limited on 3 July 2017, and signed by the Chairman of the National Forest Board, ‘proper process was not followed’.

Sabuin states that no public hearing on the FCA application was held as required under the Forestry Act, the Oro Provincial Forest Management Committee did not approve the application until after the FCA was already granted and the performance bond imposed, K100,000, ‘does not match the magnitude of the proposed operation’.

Despite what he wrote in the Ministerial Brief, according to a media report, Tunou Sabuin back tracked. Now he says the logging operation is not illegal and will not be shut down.

Instead, Northern Forest Products is being fined K150,000 for ‘technical oversight of harvesting procedures’ and the export of the stockpiled logs has been approved.

While the Forest Authority may have wavered over the legality of the logging operation, PNGi previously reported that Oro Governor, Gary Juffa, appeared to have no such doubts. Juffa has taken decisive action in conjunction with the police.

According to media reports and social media posts from the Governor, police have raided the Northern Forest Products logging camp, shut down the logging operation, seized the equipment, arrested 13 Asian employees and charged the site manger with stealing logs.

It is alleged the arrested employees, from Malaysia and Indonesia, did not have valid entry permits or work visas and were illegally employed.

Northern Forest Products took out legal proceedings against Juffa.

The Post-Courier notes, ‘the court, in its ruling, found that the logging company had abused the [legal] process by filing multiple court cases at the District Court in Port Moresby, National Court and Supreme Court simultaneously, seeking the same relief, which was to restrain Northern Governor and others from interfering their operations … Northern Forest Products Limited was also ordered to pay damages’.

Following the court decision Governor Juffa observed, ‘the company and its lawyers abused the interim court order to unlawfully secure impounded machines with the help of police and facilitated the illegal shipment of more than K3 million worth of longs we had impounded’.

Despite these controversies Hii has managed to sell off some of his land holdings in PNG, to other foreign investors for significant sums.

For example, it is reported that Ang Agro Forest Management Ltd has registered rights over three plots of land measuring 44,342ha in Oro Province, through a 99 year state lease, and two 49 year SABLs. The land is earmarked for palm oil.

At the time Ang Agro Forest Management Ltd was reportedly owned by Collingwood Plantations Pte Ltd (CPPL), a vehicle used by Eii Sing Hii.

Dutch NGO Aidenvironment argued in 2014 the SABLs were improperly acquired:

In reality, these parcels (143c and 113c) were secretly leased out by two local companies (Sibo Management Company and Wanigela Agro-industrial Limited owned by a handful of non-resident individuals). They had hooked up with Ang Agro to see the lands sub-leased to CPPL without the legally required free, prior and informed consent (FPIC) of most Maisin clans in Collingwood Bay. In July 2012, regardless of the lack of FPIC and that the gazettement violated the national moratorium policy on the issuance of SABLs set out by the PNG Cabinet a year earlier, Mr. Hii and his local partners succeeded in seeing the PNG Lands Department gazette the two SABLs in July 2012. The gazettement enabled Ang Agro to engage overseas investors who would bring in the capital to start logging out the forests of Collingwood Bay. KLK and Batu Kawan put up US$ 8.7 million and US$3.2 million each for their respective stakes in CPPL.

Eii Sing Hii reportedly retains a 31% stake in the company through CPPL.

Later in 2014, The National Court declared that the two Special Agriculture and Business Leases, covering 38,350 hectares of land, were null and void and ordered the State to cancel the title deeds.

Abuse of Power

Returning to Bootless bay. The Hii family resume suggests Lucky Manoka was pitched against wealthy, resourceful and litigious Malaysian businessmen, who appears to have used in some cases questionable means to generate their significant wealth.

The National Court in its November 2019 decision traced the history of the contention between Bootless View Estate and Amazon Realty in detail.

Manoka had incorporated Bootless View Estate Limited in February 2005. Later in July Bootless View Estate Limited applied for a Land Board tender over an agricultural lease for Portion 878 at Bootless Bay.

Following a Land Board meeting in September 2005, Bootless View Estate was informed its bid was successful. Then there was an appeal from an unsuccessful applicant. Another Land Board was convened in January 2006 to rehear the applications. Bootless View Estate won again. Amazon Realty Ltd appealed.

In a move that was slammed by the National Court, the lease was awarded to Amazon Realty on 27 of March 2006, on the advice of the Minister for Lands, Puka Temu. His support for this award, in turn, was based on a submission he received from the Departmental Secretary, Pepi Kimas.

Bootless View Estate, aggrieved by this apparent abuse of power, wrote to the Lands Secretary on 27 March 2006. Some five months later on 22 August 2006, they finally got a reply from Pepi Kimas. Bootless View Estate was informed that the matter had been referred to the Department’s legal division. No further correspondence was received from the Secretary, or the legal division. It appears the Departmental wheels turn quickly for some, such as Amazon Realty, and not at all for others.

Undeterred Bootless View Estate reached out to senior managers in the Lands Department for advice, including the Registrar of Titles. The company was advised ‘proper procedures were not followed by the Department when issuing the lease’ to Amazon Realty, the Court notes. Additionally, ‘there were suspicions about the manner in which the lease was issued to the fourth defendant [Amazon Realty], including the speed at which it was issued’.

The illegal lease awarded to Amazon Realty, the Court found, hinged on the Business Statutory Paper written by Pepi Kimas. In the paper Kimas informed his Minister that Bootless View Estate had breached the tender requirement for the agricultural lease. Kimas argued that at a later phase, after the initial agricultural project was developed, Bootless View Estate had proposed residential accommodation. Kimas advised this was outside the tender remit. Thus the lease should be awarded to Amazon Realty.

Image: Justice Les Gavara-Nanu

Judge Gavara-Nanu debunked the core premise underpinning Secretary’s decision:

The main argument by the Secretary for Lands in his advice or brief to the Minister for Lands was that the plaintiffs’ proposals were in breach of the tender requirements because the land was advertised for agricultural development, but the plaintiffs’ proposal was to develop the land for agricultural purposes in the first stage of development then residential development in the second stage. However, it is very significant to note that the proposal by Amazon Realty Limited (fourth defendant) was detailed and was in serious and flagrant breach of the tender requirements than the plaintiffs … In my view the type of residential development proposed by the plaintiffs [Bootless View Estate] were not out of ordinary, because as a large scale agricultural development, it would naturally need residences for the employees. The fourth defendant on the other hand proposed residential as well as commercial developments apart from agriculture.

Amazon Realty’s proposal for the Bootless Bay site was cited in detail in Justice Gavara-Nanu’s decision, complete with its numerous typos:

“Stage 1 – Agricultural development of mix farming, paultry, piggery and vegetable farming and banana planting at a total cost of K350,000.00.

Stage 2 – Rezoning the land to light industrial, commercial, residential and other zoning. Provision of Services (sic.) such as roads, sever (sic.) water, cable and power lines the estimated cost of which will be well over K18 million.

Stage 3 – Light Industrial and Commercial Developments – Shopping complex, sawmill, vineer processing, warehouse sheds, a wharf and a jetty that will cost well over K345 million.

o Light Industrial and commercial development K300m

o Wharf development K30m

o Shopping complex K15m

Stage 4 – Residential, Hotel and Recreational Development. Residential properties, five star hotel and recreational facilities would cost well over K450m.

Residential properties and recreational facilities K150m

Five Star Hotel including international std casino K300m.

The overall development of the lease will cost approximately US$271 million.

Justice Gavara-Nanu’s observes: ‘The detailed proposals by the fourth defendant [Amazon Realty] make its intentions very clear that it wanted to venture into almost 100% residential and commercial development and very small percentage of its proposal was for agricultural development. This was a blatant breach of the tender requirements’.

He concludes the judgement by censuring the Minister and his Secretary for their illegal actions:

It is clear that the Secretary for Lands and the Minister for Lands, who are the first and second defendants in this proceeding, took into account improper and irrelevant considerations when upholding the appeal against the Land Board recommendations favouring the second plaintiff, and issuing the lease to the fourth defendant. The advice to the Head of State was wrong in law and it amounted to an abuse of power by the Minister for Lands.

As a result the lease issued to Amazon Realty was declared ‘null and void’ by the National Court. An order was made for a new lease to be issued to Bootless View Estate, with the State and Amazon Realty paying their legal costs.

The victory though of Lucky Manoka and Bootless View Estate should not be the end of this matter.

Questions now have to be ask of the then Lands Minister, Puka Temu and his Secretary, Pepi Kimas.

Why did they overrule the Land Board?

Why did they support an outfit whose business proposal clearly violated the tender conditions?

How could they have been satisfied that a small outfit, in a financially precarious position, could spearhead a US$271 million mega-development that would be arguably the largest in the country’s history?

Did Mr Kimas or his senior officers have any contact with Malaysian businessman Eii Sing Hii relating to the land deal?

And what motivated the public officials involved to abuse their power in the interests of Amazon Realty?